2021-Best Home Securtiy Systems.

SimpliSafe is ideal if you desire a popular brand that will protect your residence but also for method less cash than you would certainly pay for the ADT`s of the world. Lots of people know the name “SimpliSafe” now, and vivint nest it makes it low-cost and easy to set up an alarm in your residence. If you desire a protection system that will secure your home and also make your next-door neighbors state, “Wow, where `d you obtain that?

Which is better SimpliSafe or ring?

If you`re interested in what`s going on in your neighborhood as well as inside your home, Ring is a better DIY home security option than SimpliSafe because Ring has a wide variety of outdoor and doorbell cameras and a neighborhood video sharing program.

Please likewise keep in mind that use our Site undergoes the Website Regards To Usage. These various sorts of security system refer to the technique of connection in between the pieces of equipment as well as whoever`s keeping an eye on the system, whether it`s you or a professional tracking facility. A landline system uses the telephone cables in your house, a broadband system uses your home`s internet, and a mobile system uses the wider mobile network. Wireless home security systems are attached by a mobile or Wi-Fi network. Wireless systems are usually faster to mount than wired systems and also are simple to carry between locations.

Control your whole Precursor Do It Yourself, Wi-fi protection system from any type of mobile phone. With Scout, you can have complete control of your home from anywhere in the world.

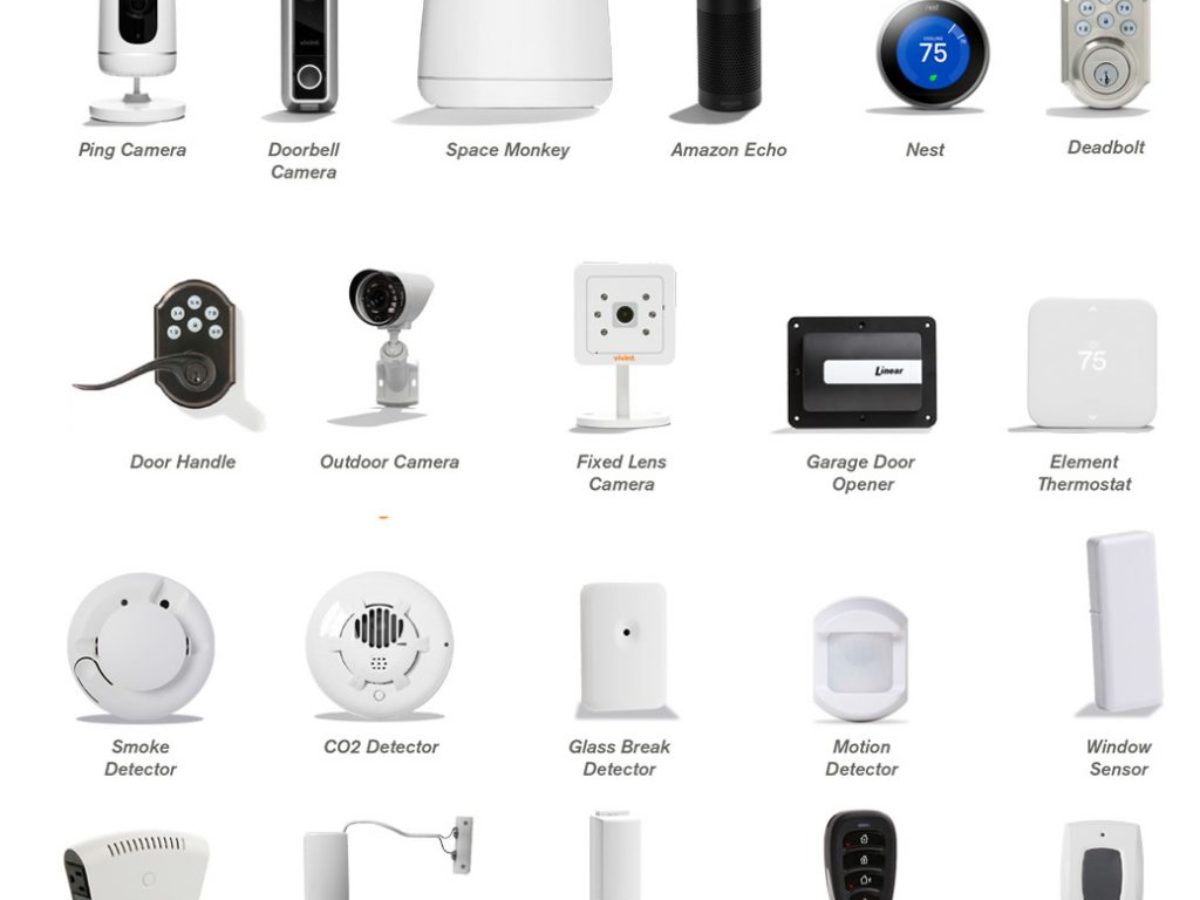

How do I choose a security camera for my home?

How to Choose a Home Security Camera 1. Choose Your Camera Type. The type of camera you`ll need depends on where you want to place it.

2. Pick Your Power Source.

3. Compare Cloud Storage Plans.

4. Consider Your Privacy.

The contacts communicate in real-time to the Alert 360 panel as well as detect when a door or home window is open or closed, giving you comfort when home or away. Alert 360 infrared activity detectors safeguard the within your home from instruders by watching for motion task as well as reporting to the Alert 360 system panel. The activity detectors are also pet-immune tor animals vivint add user up to 50 pounds. and will spot activity even in dark rooms using infrared light. Alert 360 intrusion gadgets are what keep your home safe. Each intrusion sensor interacts straight to you Alert 360 panel offering your home 360 degree real-time defense from the inside out.

Home Security.

Or maybe you wish to make your home as smart as you are. Whatever you need, we can assist personalize a home security system that makes good sense for you. If someone that isn`t supposed to tries to enter your home, your safety system is equipped with door or home window sensors which will cause the high-decibel alarm as well as alert you and ADT. Please offer info on any type of bug or vulnerability that has been found in ADT items, services, and internet sites. With Alarm New England home security tracking, each home security system in Rhode Island is frequently checked 24-hour a day, 7 days a week, every single day of the year. In case of an emergency, we intend to make certain your provider is there for you. Our team considers keeping an eye on services, response time as well as other functions to aid you call for aid when you require it most.

- Voice control is just one of the latest smart home features being incorporated into contemporary safety systems.

- Link Interactive has a wide variety of devices to choose from.

- If you run into any concerns, protection firms provide assistance over the phone.

- These cams stream live video footage to customers, permitting them to expect questionable task.

Vivint calls for 24/7 specialist surveillance with its smart home and protection devices. Tracking needs an agreement and also starts at $29.99 per month. Monitoring may set you back even more depending on the number of cams set up. Furthermore, tools that attach through Wi-Fi, such as security cams and also smart door locks, can be hacked to gain access to your home network. An experienced hacker can after that use your Wi-Fi devices and also other network resources to carry out Distributed Rejection of Service strikes versus larger networks. Probably a lot more disturbing is the suggestion of some unfamiliar person monitoring video from your interior and also outdoor safety cameras. Many outdoor cameras provide movement detection with push and also e-mail alerts, night vision, and cloud storage for event-triggered video, and also some pull double responsibility as floodlights or patio lights.

There are several steps you can take to make certain your home security system is secure from destructive cyber intruders. For starters, change the system`s default password with a distinct one which contains a mix of letters, numbers, and also icons. Inspect the safety and security setups on yourwireless router, as well as consider designs that add an added layer of software defense, like theBitdefender Box 2. Keeping track of for skillfully mounted systems has a tendency to be more costly. The Brinks Smart Safety Important system sustains voice control and also collaborates with a host of Z-Wave elements, yet it needs a multi-year tracking contract and takes a long period of time to establish.

We like that Scout supplies RFID door sensing units and also stickers to equip and deactivate the system quietly. Scout is a Do It Yourself smart protection option that gives you much more control of your safety and also smart home devices. Your pack connects your favorite smart lights, garage openers and also even more. You`ll have supreme control and also comfort along with Scout. Unlike common ADT solution, Blue by ADT offers you the option to self-monitor your home or choose expert surveillance. If you determine to let the experts do it, your first month of surveillance is free, as well as it`s just $19.99 plus tax afterwards. By doing this, you can acquire the equipment as well as miss the expert tracking.

Not only does smart modern technology offer you the capacity to manage and also monitor your home alarm from anywhere– it likewise makes your system able to react to your practices and regimens. When combined with home security, home automation can help enhance your home`s power effectiveness, from another location manage your alarm, and also let you check in on kids or animals when you`re away from home. Both shield your home just fine, but cordless systems have extra garage door controller vivint versatility if you may move or don`t wish to place holes in wall surfaces. A hardwired system can be the ideal choice if you want a full smart home and also you`re able to include the installment right into an improvement or new building and construction. ” Wireless” describes using cordless technology like Wi-Fi or Bluetooth for monitoring and to connect the parts of your system. ” Wired” describes a home security system that is hardwired right into your home`s electric system.

Is Ring cheaper than ADT?

Let`s cut right to the chase: ADT is much more expensive than Ring Alarm, but you get what you pay for. Their Essential package costs about $37 per month (opposed to Ring`s $10 monthly fee). It includes 24-hour monitoring, three keypads, motion detectors, three window sensors, a siren, a back-up battery, and a remote.

We`ve NEVER increased our basic surveillance price, and no other home security business in Houston can state how to change battery in vivint smart thermostat the same. Smith Thompson Home Security not only gives superb service, we don`t increase our rates.

WordPress Security: In depth Information to help keep your Web site Safe in 2020

Honestly talking, WordPress web sites will be the most targeted by con artists and hackers. At these kinds of a period when Cybercrime has increased considerably, there’s a requirement to protect WordPress websites from all sorts of hazards along with its a great idea to work with a WordPress Expert like WP Tangerine (website). It’s only when your website becomes hacked when you will certainly be hit by the fact of the importance of securing the internet site.

Thirty thousands (30,000) websites are hacked every day and webmasters shed an incredible number of dollars to these crooks. The reason being consumers must continue to keep modernizing Themes and Plugins to maintain the site secure. In addition, over a quarter of all the web sites out there are WordPress websites together with that reputation, hackers focus on them. In this particular brief, I’ll reveal a step-by-step manual on how to keep the website protected.

Monitor the WordPress Up-dates

WordPress is one of the websites where a huge selection of folks contribute to its improvement. What this means is that new updates are released frequently. A few of these updates tend to concentration more on WordPress website’s protection. As the WordPress features get rid of time, the website becomes more susceptible to online hackers and other types of criminal acts.

Keep the safety updates automatically

Updates for minimal and security features have been set up auto by default from your release of WordPress 3.7. As a result, your site is receiving these changes as soon as they show up in the marketplace. But remember, there are several website hosts that blocks automatic upgrades. In case you discover this is just what is going on along with your Hold, use a distinct one or keep watch over the upgrades to commence handbook upgrades rapidly.

WordPress Core must be generally up to date

Generally, WordPress end users must start these Core changes personally. So, when there’s a significant revise, check out the banner ad on top of the dashboard and Initiate the upgrade. This means gain access to major safety updates.

Themes and Plugins ought to always be up-to-date

One good reason that WordPress Websites are particular is because consumers should keep your Themes and Plugins updated frequently. The process of upgrading Themes and Plugin is guide and time consuming but it is usually essential. Make sure the available upgrades on Dashboard> Changes.

Use User Permissions and robust passwords

Most online hackers use thieved passwords gain access to your internet site. Consequently it is under your control to protected the web site or help it become hard for Online hackers to guess you Security passwords. Never just constantly modify the WordPress admin region security passwords however in other areas such as WordPress Web hosting service bank account, Personalized e-mail address as well as the FTP balances.

Get a WordPress Back up Solution

One method to ensure you never shed your information in the case of perils of Hacking is always to Back up your information. Choose the ideal Backup Plugins for WordPress web site. The truth is all internet sites are vulnerable to hacking, so be well equipped and in case the worst happens, usually search for WordPress Support from a trustworthy WordPress Consultant like WP Tangerine (wptangerine.com).

Boost Your Profits Through Video – Tips and Tricks for Internet Marketers

If you started doing some serious searching, you will see the numbers of discussions centered on video marketing. There are certain issues that do tend to spread out into other areas of consideration, and that cannot be ignored. One thing Tyler Tysdal doesn’t see talked about much is how important it is to pay attention to things that may initially appear to be less important – often times they can be very important. As you know, this is a broad topic of discussion, and that is why it will be helpful for you to think in broad terms. Even if you feel that a particular application or piece of information does not speak to you directly, we urge you to have an open mind about it.

Internet Marketing is one of the easiest ways to make money, yet it will not earn a dime without visitors to your projects. You can do this in several different ways. A couple of the top choices would be writing and submitting articles; you could also try advertising. If you want to generate a lot of traffic, focus your Internet marketing efforts on videos.

Using videos to generate traffic

Videos are used by generally everyone to generate traffic. By using videos, you can actually showcase your product or service in ways that are very profitable. In this article we are going to teach you some of the things you need to know if you want to make sure that your videos are good and worth watching.

Tags are very important. Always put tags with your videos. The use of tags is often associated with written content or something to do with programming. The truth is that there are plenty of places to use your keyword tags in your videos. Each video that you upload should be tagged accordingly. You enter these tags or keywords in a certain section before the video is live. You should also make sure that those keywords are included in your title. Sprinkling your keywords in the description of your video should also be done. Though they are not articles with text, videos can place very well in Google, Yahoo, and other search engines making them very useful for traffic generation. Just pay attention to making sure the video is properly optimized. No information by itself will move you to action, and that is true for business , as well. Most people, the majority of them, do nothing all throughout their lives and nothing good happens from that.

Making crucial business decisions

If you want things to change in a positive way, then you need to find a way to motivate yourself on a daily basis. The most critical aspect of this is making the decision that you will make a difference in your life. We all know it is easy to think about things, but the other part of the equation is the movement part – move toward your goals. Let’s see what else there is to know about this topic.

Your products and services should be represented in your videos like a conversation. This works best if you have a series of videos. You can start the series by introducing yourself and what you have to offer and then asking for questions. From there, you can answer one or two questions for videos. What you are able to do with these videos is answer any questions your viewers may have, establish your brand and name, and market your products. Videos like this are a great way to get the ball rolling on your business without too much effort.

You should also have basic video production techniques down. Learn which angle is the most flattering for you. Lighting your space properly is something else to consider. If you can do cuts and fades, your video will look even better.

You don’t need a bunch of fancy equipment for this. Once you have your software and camera, plus some good lighting, you are good to go. The more effort you put into making sure your video looks professional the more likely people are to trust you. Nobody wants to buy from the person who is obviously sitting on the floor in his bedroom. Visuals matter. Make your videos as professional as possible. This is very important! There are all sorts of ways to promote your products and to run marketing campaigns. These days, it’s only sensible to make videos in addition to anything else you might be doing. Your videos must, of course, be appealing and fun to watch if you want to achieve anything from them. Use the tips in this article to help make sure that your videos are good and helping your marketing efforts go as far as they can go.

There are probably millions of people who are potentially impacted regarding business. Indeed, perhaps most people would never think of it or realize what it can do or even when it could make its presence known.

Probably the best defense against such situation is paying attention to your thoughts and keeping your eyes wide open. We all know the saying about an ounce of prevention, but still that holds true in very many situations. Have you not ever noticed that about people or even yourself? It does seem to be very prevalent in our opinion. That is why we always urge those we communicate with to become knowledgeable and keep learning. Visit https://topnewsscoop.com/ to further enhance your business knowledge and skills.

Do You Need Business Brokers?

Court of appeals ruled that the declarations were made “in connection with” purchases and sales being made by investors on the open market. Insider Trading Rule 10b-5 safeguards versus expert trading, which is a purchase or sale by an individual or persons with access to info not readily available to those with whom they deal or to traders typically.

Starting in the early 1960s, the SEC broadened the scope of the guideline. The rule now runs as a general restriction against any trading on details in confidential stock market deals, in addition to standard in person proceedings. For instance, in In re Cady, Roberts & Co., 40 S.E.C. $ million care. 907 (1961 ), a partner in a brokerage firm found out from the director of a corporation that it planned to cut its dividend.

In another case officers and staff members of an oil company made large purchases of company stock after finding out that exploratory drilling on some business residential or commercial property looked very promising (SEC v. Texas Gulf Sulphur, 401 F. 2d 833 [2d Cir. 1968]. In these cases the individuals who made the deals, or persons who passed information to those people, were found to have actually breached guideline 10b-5. Nevertheless, not every circumstances of monetary unfairness increases to the level of deceptive activity under rule 10b-5.

Sec Definition – What Does Securities And Exchange – Ig.com

United States, 445 U.S. 222, 100 S. Ct. 1108, 63 L. Ed. 2d 348 (1980 ), Vincent F. Chiarella, a worker of a monetary printing company, worked on some files connecting to contemplated tender deals. He established the identity of the targeted business, purchased stock in those companies, and then offered the stock at an earnings once the tender deals were revealed.

Tyler Tivis Tysdal Securities and Exchange Commission (SEC)slideshare.net

Tyler Tivis Tysdal Securities and Exchange Commission (SEC)slideshare.net

Moreover, courts have likewise ruled that the person who passes details to another person who then utilizes it for a transaction is as culpable as the individual who uses it for his or her own account. The test for materiality in a guideline 10b-5 insider info case is whether the information is the kind that may affect the judgment of affordable financiers, both of a conservative and speculative bent.

The Insider Trading Sanctions Act of 1984 (Pub. L. No. 98-376, 98 Stat. 1264) and the Expert Trading and Security Scams Enforcement Act of 1988 (15 U.S.C – singlefamily office active.A. 78u-1, 806-4a, and 78t-1) changed the 1934 act to allow the SEC to look for a civil penalty of three times the quantity of earnings got from the prohibited transaction or the loss avoided by it.

What Is The Sec?

Tyler Tysdal extractive industries disclosure rule …fcpablog.com https://www.youtube.com/embed/WhJVIagxxwk

Tyler Tysdal extractive industries disclosure rule …fcpablog.com https://www.youtube.com/embed/WhJVIagxxwk

A whistle-blower may get up to 10 percent of any civil liability penalty recuperated by the SEC. The optimum criminal penalties were increased from $100,000 to $1 million for individuals and from $500,000 to $2.5 million for organisation or legal entities. Just dealerships or brokers who are registered with the SEC pursuant to the 1934 act might engage in organisation (other than people who deal just in excused securities or deal with only intrastate business).

A broker is a representative who manages the public’s orders to purchase and offer securities for a commission. A dealership is an individual in the securities service who purchases and offers securities for her or his own account, and an investment adviser is paid to encourage others on purchasing, acquiring, or selling securities – customer malfunctioning product. Tyler Tysdal Securities and Exchange Commission

Tyler Tysdal Securities and Exchange Commission

80b et seq.). This law attends to registration comparable to that in the 1934 act for brokers and dealerships, however its coverage is usually not as thorough. Certain fee plans are restricted, and adverse personal interests in a deal should be disclosed. Furthermore, the SEC might specify and forbid specific deceitful and misleading practices.

How Does The Securities And Exchange Commission Work

Similar provisions use to municipal securities dealerships and financial investment advisers. Issues might arise in a number of methods. For instance, a broker-dealer might recommend or sell securities without appropriate details about the issuer. “Churning” is another issue. Churning occurs when a broker-dealer creates a market in a security by making duplicated purchase from and resale to individual retail consumers at progressively increasing costs.

Tyler T Tysdal is an entrepreneur and portfolio manager with prior experience from Cobalt Sports Capital. Tyler Tysdal, a successful businessman is teaching crucial service tricks to entrepreneurs to help them be successful at an early age. Tysdal together with his business partner, Robert Hirsch is sharing crucial pieces of understanding with young business owners to help them satisfy their dreams. At Freedom Factory, the seasoned business broker and financial investment specialist, is likewise helping entrepreneurs in selling their businesses at the right value.

Churning also happens when a broker triggers a consumer’s account to experience an extreme variety of transactions entirely to create repeated commissions. Deceitful “scalping” happens when an investment advisor publicly suggests the purchase of securities without disclosing that the consultant purchases such securities prior to making the recommendation and then offers them at an earnings when the cost rises after word of the recommendation spreads.

78q-2), which provides the SEC authority to regulate the extensive incidence of high-pressure sales tactics in the peddling of inexpensive speculative stocks to unsophisticated investors. Dealers in penny stocks should offer consumers with disclosure documents talking about the threat of such investments, the customer’s rights in case of fraud or abuse, and payment received by the broker-dealer and the sales representative dealing with the deal. invested lost $.

About – The Securities And Exchange Commission News

Tysdal U.S. Securities and Exchange Commission

Tysdal U.S. Securities and Exchange Commission

78aaa et seq.) developed the Securities Financier Security Corporation (SIPC) to supervise the liquidation of securities firms struggling with financial troubles and to set up for the payment of clients’ claims through its trust fund in the event of a broker-dealer’s personal bankruptcy. SIPC is a government-sponsored, private, nonprofit corporation. Itrelies on the SEC and self-regulatory companies to refer brokers or dealerships having monetary difficulties (lone tree man).

SIPC ensures repayment of cash and securities approximately $100,000 in cash equity and up to $500,000 total per consumer – private fund titlecard. Although the SEC plays a significant function in regulating the securities market, policy duties likewise exist for self-regulatory organizations. These organizations are personal associations to which Congress has actually delegated the authority to devise and implement guidelines for the conduct of an association’s members.

The 1934 act needed every nationwide security exchange to sign up with the SEC. An exchange can not be registered unless the SEC determines that its guidelines are developed to prevent fraud and manipulative acts and practices and that the exchange offers suitable discipline for its members – securities fraud theft. Congress extended federal registration to non-exchange, or OTC, markets in 1938 and licensed the facility of national securities associations and their registration with the SEC.

Securities And Exchange Commission (Sec) – Allgov

In 1975 Congress expanded and consolidated SEC authority over all self-regulatory companies. The SEC must provide previous approval for any exchange rule changes, and it has evaluation power over exchange disciplinary actions. Under the Financial Investment Business Act of 1940 (15 U – partners impact opportunities.S.C.A. 80a et seq.), financial investment companies must register with the SEC unless they certify for a specific exception.

They may also be business with more than 40 percent of their assets consisting of “investment securities” (securities besides securities of majority owned subsidiaries and federal government securities). Financial investment companies consist of “open-end companies,” typically called mutual funds. The SEC regulatory obligations under this act encompass sales load, management agreements, the composition of boards of directors, capital structure of investment firm, approval of advisor contracts, and modifications in financial investment policy.

Every investment firm must sign up with the SEC. Registration includes a statement of the business’s investment policy. Moreover, an investment firm should submit annual reports with the SEC and preserve particular accounts and records. Strict treatments protect versus looting of investment firm possessions. Officers and workers with access to the company’s cash and securities must be bonded, and larceny or embezzlement from an investment firm is a federal crime.

Home Security – A Value For Money

That’s just due to the large size of the place and the number of sensing units and entry points that are needed. But Vivint can handle big and little houses similarly well. The majority of consumers who have Vivint are actually paying between $30 and $35 for their monitoring. They can pay a bit more if they need a lot of extras, and it’s generally not practical for them to be paying any less.

That’s a subjective viewpoint that’s going to be a concern for some individuals and not for others. In any case, nevertheless, it’s worth considering whether there’s a real issue at stake for consumers. When a comparison is done in between business, it’s important to bear in mind that a lot of security companies are very similar in what they use.

Usually, a house owner must try to find a business that offers:24/ 7 tracking capabilitiesreliable protection and alertingequipment that’s quality and simple to useresponsive customer service personnelan easy installationIf a consumer can get all of those things in a home security system for a good cost, than that consumer can assume that they’re generally getting a good worth – equipment purchased upfront.

Vivint only began life in 1999, however because then has actually grown to end up being a major gamer in best home security systems and automation. Vivint keeps it basic. There are just 3 monitoring packages to choose from and they all come with cellular backup as standard. Cellular backup suggests Vivint can still monitor your home even in the case of a power cut when WiFi may be down.

Even though Vivint is a smart home business as much as a security company you do not get smart home integration with every bundle. sensors motion sensor. You likewise require to pay extra for video tracking, although this is pretty standard for most business. Vivint is a professionally installed system, which implies someone comes in your house and installs all the Vivint-branded devices.

The devices tends to be more expensive than rivals and you require to include the setup fees on top of that. louisiana vivint louisiana. If you come in handy, then it is worth taking a look at more cost-efficient options like SimpliSafe or Brinks. Item Specifications 3-days Professional 24/7 Yes$ 550 $29.99 Wireless Yes (optional) $99There are presently three home security system plans offered from Vivint.

Home Security Package

It aims to get you on a call to discuss your requirements, but at the very same time the sales representative might try to sell you more than you need. The exact same goes for the installers that pertain to your home. Make certain you have actually done your homework and read this Vivint review prior to speaking with them.

You Might Also Be Interested in These Particular Stories

BigMike Straumietis CEO of Advanced Nutrients.

If you do choose to opt for Vivint make sure you do it via the site or by phone. Devices begins at $549.99 $99 setup $29.99 a month monitoring 42 to 60-month contract Devices starts at $549.99 $99 installation $39.99 a month monitoring 42 to 60-month contract Equipment begins at $749.99 $99 setup $49.99 a month tracking 42 to 60-month contractThe above rates are where each plans costs begin, installation and regular monthly monitoring might end up being greater depending upon your circumstance.

Vivint Smart Protect is the very first sounded of Vivint’s monitoring plan ladder. It comes with the Vivint SkyControl touchscreen panel. This is a touchscreen tablet that interacts with all the suitable smart security and smart home products in your house and has a microphone and speaker for 2-way interaction. You also get all the same features through the Vivint Sky app you can use on your mobile phone. home security companies.

The plan includes 24/7 monitoring which can cover carbon monoxide gas, smoke and medical signals, in addition to security tracking. You will require to purchase additional equipment from Vivint to make the most of these features – reviewed information redacted. Vivint Smart Protect doesn’t include smart home automation and video monitoring, you’ll need to update your regular monthly package for those features.

You can either spend for the devices outright or add it to the cost of your month-to-month charge with 0% interest. The benefit of spending for it outright is that you won’t need to connect yourself up with the long contract – taxes local permit. In either case it will need to be professionally installed by a Vivint installer with costs starting at $99. Vivant Basic includes the Vivant Sky Control (Image credit: Vivint Home Security) Vivint Protect + Control is a basic upgrade to the basic Smart Protect plan and adds home automation to the mix.

Vivint Smart Protect + Manage expenses $39.99 a month and needs 42-month contracts as minimum, although (similar to all Vivint’s packages) decide to spend for the equipment in advance and you can choose a rolling month-to-month agreement. Vivant Protect + Control permits the addition of smart home devices (Image credit: Vivint Home Security) The most expensive regular monthly alternative is Vivint Smart Complete, which adds video monitoring to the Smart Protect plan.

Commercial Certificate Vivint

There are three cameras to select from that variety in price. The Vivint Doorbell Camera changes your doorbell and lets you have a 2-way discussion with visitors through your phone or panel. It has a wide-angle lens to get whatever in front of it in view and can also acknowledge people, so you don’t get informs if you don’t require too.

The Doorbell Camera presently costs around $200, which is on par with similar offerings like the Ring Video Doorbell 2. security camera system. The Vivint Ping electronic camera likewise costs around $200. This is a little cordless indoor security electronic camera that lets you start a video call to your smartphone or tablet. That means your kids can start a call with you rapidly if something is taking place in your home and you can talk to each other through it.

What are the complaints against vivint home security that people should be aware of?

Finally we have the Vivint Outdoor Cam, which as the name suggests, can be set up outdoors without stressing over severe weather. It doesn’t included 2-way audio like the other cams, however, and costs around $300. That’s a fair amount more than lots of other outside wireless cameras. ADT’s outside video camera expenses around $200, as does the Nest Camera Outdoor, while the Arlo Pro 2 costs $219.99.

Extra video cameras cost $5 a month each, plus the expense of the camera naturally. You get 14 days of storage of 30-second video clips for that. If you want more you can also choose for the Vivint Smart Drive. This costs $249 and ups your Smart Complete strategy to thirty days worth of tape-recording for as much as 4 electronic cameras (security systems vivint).

Vivint Smart Total features the doorbell camera for additional piece of mind and security (Image credit: Vivint Home Security) Vivint uses a 120-day limited service warranty for equipment, which is a little better than, for example, ADT’s 90-day offering. After the 120 days Vivint will still replace a defective item totally free of charge, nevertheless you will need to pay a service fee for each go to (security system smart).

This costs an additional $10 a month. That’s $3 a month more than ADT, but they also charge a $25 service fee if you call an engineer to your house (alexa google assistant). If you decide to end your contract with Vivint prior to its term is up then you will require to pay 100% of your outstanding balance.

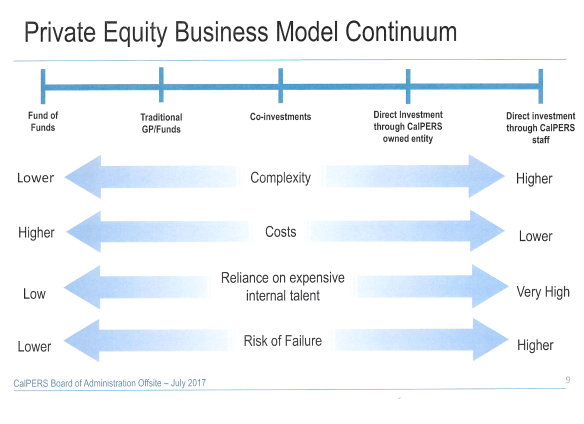

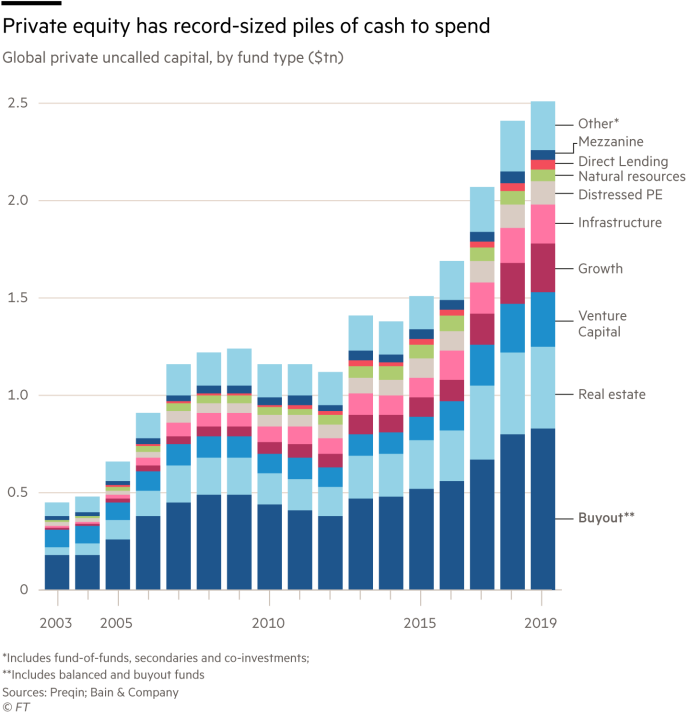

Private Equity: The Biggest Problems That Firms Face Today

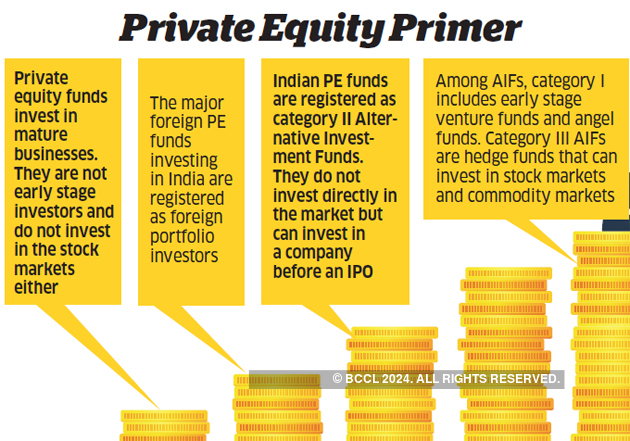

A lot of hedge funds have portfolio supervisors that will actively designate the funds among various securities, mainly in public companies or securities that are traded through some liquid or nonprescription marketplace. Thus they rely on real-time market information, to market their holdings on an everyday or perhaps on an intra-day basis, and have to first collect the assets which are “domiciled” with the custodian or the prime broker – indicted counts securities.

Many hedge funds, especially the larger and more successful ones, might ask their customers to “secure” assets for approximately a period of three years. However, the gains and losses in the funds are reported regular monthly and tracked daily by the funds’ management. Private equity companies might charge fees on a comparable basis, ie a management cost and an efficiency fee.

An investor usually does not need to transfer funds into the private equity firm up until the funds are “called” based upon the financial investments the firm is making (fund manager partner). These firms invest in private firms (thus private equity), or take a private stake in public firms (PIPELINES), and do not mark to market their holdings as there may not be a public appraisal of them up until an exit or sale is happened.

These companies have much longer life-cycles (generally) in the investments they make instead of hedge funds, and do not require real-time market data-feeds. The lock-up for private equity companies is often seven years or more. These firms are trading illiquid possessions and require a a lot longer period to recognize, invest and after that exit the business.

Private Equity, Explained

Another distinction is in threat management. While hedge funds use metrics like VaR and look at alpha and beta (market and outright correlation), the private equity firms have a more bottom-up technique to risk management based upon research and the management group of the companies in which they take a stake.

While hedge funds predominantly have actually had traditionally high net worth investors, and just recently more and more institutional investors, they also have actually been more available to individual investors. Private equity firms, on the other hand, are generally less accessible to individual high net worth investors and attract more ultra-high internet worth investors and institutional investors.

Examples of a few of the larger hedge funds are ESL, Eton Park, Farallon Capital, Moore Capital, Och-Ziff, and TPG-Axon while examples of private equity companies are The BlackStone Group, The Carlyle Group, JP Morgan Capital Partners, TowerBrook Capital and the Texas Pacific Group. Besides their service designs, these companies likewise vary in their requirements and usage of technology.

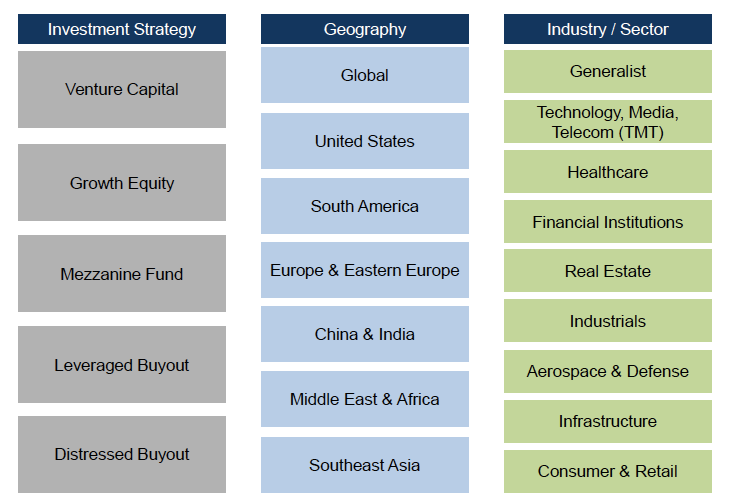

Particular funds can have their own timelines, investment objectives, and management viewpoints that separate them from other funds held within the same, overarching management firm. Successful private equity companies will raise lots of funds over their life time, and as companies grow in size and complexity, their funds can grow in frequency, scale and even specificity. To find out more about private equity and also - visit his videos and -.

Tyler Tysdal is a lifelong entrepreneur assisting fellow entrepreneurs sell their organisation for optimum worth as Managing Director of Freedom Factory, the World’s Best Business Broker situated in Denver, CO. Liberty Factory assists entrepreneurs with the greatest deal of their lives.

Private equity firms primarily need a great and reliable phone system, e-mail and ability to share MS Word, Excel and PowerPoint files. Thus they need much easier network infrastructures. Both, however, have a requiring end-user neighborhood that requires first-class service and timely action to their respective requirements. Hedge funds typically utilize one or several prime brokers and fund administrators, whereas private equity firms typically do not need any.

Private Equity Firms Target Dealmaking Opportunities Amid Turmoil

Both types of organisations are similar in many ways, however likewise have particular unique characteristics with regards to the investors they draw in, the sort of operations they require to set up and the innovation they need to support them, both internal and that offered by 3rd celebrations. About Gravitas Gravitas Technology, with its “white glove” services method and several legs of offering where we see technology holistically, has actually been providing a broad variety of integrated IT services consisting of consulting, software advancement and infrastructure combination since 1996.

We have broadened our delivery capacity and enriched our offerings with best-of-breed delivery partners consisting of: Constatin/Walsh-Lowe, Globix Corporation, and MTM Technologies. Gravitas continues to be the preferred service provider of IT services to the hedge fund market, having secured the launches of over 25 funds, including a few of the largest and most complex hedge fund customers over the last 12 months. securities fraud racketeering.

Have specific investors missed out by not having access to private equity? In weeks like these, when publicly traded stocks are getting clobbered, it might seem so. We’re about to learn the response, courtesy of Vanguard Group’s current decision to produce a private-equity fund. Though the fund initially will be available just to organizations such as college endowments and nonprofit structures, Vanguard states it eventually will be made readily available to individuals as well. indicted counts securities. https://www.youtube.com/embed/WhJVIagxxwk

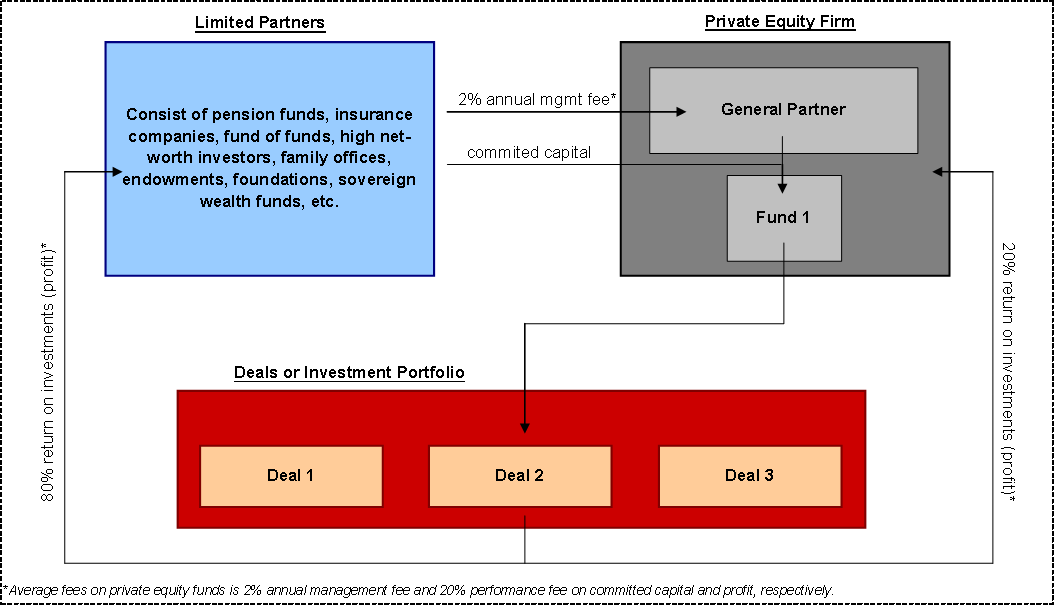

Because these investments usually are sizable, their holding period can be several years, and the risk of failure isn’t insignificant. They usually are made by private-equity firms that pool the resources of wealthy and well-connected people and organizations. There generally is a very high minimum to buy these firms, which charge significant costs, typically 2% of possessions under management and 20% of earnings.

Private Equity Funds

One that numerous investors recognize with is David Swensen, who has actually managed Yale University’s endowment considering that 1985 and been a strong advocate of alternative investments typically and private equity in particular. According to Yale, Swensen has actually produced a return that is “unequalled amongst institutional investors.” Previously, about the only investment choices for people desiring to get exposure to private equity were the stocks of those few PE companies that are openly traded, such as KKR (ticker: KKR) and Blackstone Group (BX).

Numerous of the details of Vanguard’s new fund have yet to be revealed, such as when the fund will become available, the minimum investment quantity, the charges that would be charged, and how long investors would be needed to bind their properties – private equity fund. Vanguard declined a request to provide those information.

Here are some factors to consider to remember if and when you are given the opportunity to purchase Vanguard’s new fund. Ludovic Phalippou, a professor of monetary economics at Oxford University, told Barron’s that he’s concerned about the layers of charges that potentially could be charged by this new fundas numerous as 3, in truth: From the PE funds in which HarbourVest invests, from HarbourVest itself, and by Lead. $ million investors.

The answer to this concern might effectively be “no,” says Erik Stafford, a professor of service administration at Harvard Business School. He bases his uncertainty on the disappointing performance of the largest category of PE funds, so-called “buyout funds,” which purchase openly traded companies and take them private. To be sure, he states, the average PE buyout fund has actually surpassed the S&P 500 index.

The Strategic Secret Of Private Equity

These are stocks of companies with small market caps that trade for low ratios of rate to profits, book value, return on equity, capital, etc. Such stocks are at the opposite ends of the size and growth-value spectra from the S&P 500. According to Stafford, the typical PE buyout fund has lagged an index of little value stocks.

Take a look at the accompanying chart, courtesy of information from Nicolas Rabener, creator of the London-based firm FactorResearch. Over the past three decades, private equity has significantly outshined the S&P 500, however it has actually significantly lagged a hypothetical index fund of small-cap worth stocks. (For private equity’s performance, Rabener counted on the Cambridge Associates U.S. invested $ million.

Private Equity Firm Definition

Permira, among the biggest and most successful European private equity funds, made more than 30 significant acquisitions and more than 20 disposals of independent businesses from 2001 to 2006. Few public companies develop this depth of experience in buying, transforming, and selling. As private equity has gone from strength to strength, public business have actually moved their attention away from value-creation acquisitions of the sort private equity makes.

Corporations that buy unassociated companies with capacity for substantial efficiency enhancement, as ITT and Hanson did, have actually fallen out of fashion. As a result, private equity companies have actually faced few rivals for acquisitions in their sweet area. Provided the success of private equity, it is time for public companies to consider whether they may contend more straight in this area.

As a result, private equity firms have actually faced couple of competitors in their sweet spot. We see two options. The first is to adopt the buy-to-sell design. The 2nd is to take a more versatile method to the ownership of companies, in which a desire to hold on to an acquisition for the long term is stabilized by a commitment to sell as quickly as corporate management feels that it can no longer include more value.

Specific funds can have their own timelines, investment goals, and management approaches that separate them from other funds held within the very same, overarching management firm. Successful private equity companies will raise many funds over their lifetime, and as companies grow in size and complexity, their funds can grow in frequency, scale and even specificity. For more information about fund managers and - check out the blogs and -.

Prior to establishing Freedom Factory, Tyler Tysdal managed a development equity fund in association with numerous celebs in sports and entertainment. Portfolio company Leesa.com grew quickly to over $100 million in earnings and has a visionary social mission to “end bedlessness” by contributing one bed mattress for every single 10 sold, with over 35,000 contributions now made. Some other portfolio companies remained in the markets of white wine importing, specialty loaning and software-as-services digital signs. In parallel to handling possessions for businesses, Tyler was handling personal equity in real estate. He has had a number of effective private equity investments and numerous exits in trainee real estate, multi-unit real estate, and hotels in Manhattan and Seattle.

One is the obstacle of revamping a business culture that has a buy-to-keep strategy embedded in it. That needs a company not only to shed deeply held beliefs about the stability of a corporate portfolio however likewise to develop new resources and perhaps even drastically change its abilities and structures.

Private Equity Firm Definition – Nasdaq

Whereas private equity funds, arranged as private collaborations, pay no business tax on capital gains from sales of companies, public companies are taxed on such gains at the regular business rate. This business tax distinction is not offset by lower individual taxes for public company investors. Higher taxes considerably lower the beauty of public companies as a car for buying companies and offering them after increasing their worth (racketeering conspiracy commit).

This much enhances European public business’ tax position for purchasing to sell – nfl free agent. (Note that two tax concerns have actually been the subject of public analysis in the United States. The firstwhether openly traded private equity management firms should be dealt with like private partnerships or like public companies for tax purposesis carefully related to the problem we raise.

Undoubtedly, two longtime players in mid-market buyouts (those valued between $30 million and $1 billion) are public companies: American Capital Methods, which had a current market capitalization of about $7 billion, and the UK-based 3i, whose market cap is about $10 billion. Both business found methods to prevent the corporate capital gains tax (the UK eliminated the tax only in 2002) by adopting unusual organizational structuresa “company development company” when it comes to American Capital; an “investment trust” in the case of 3i.

Those constraints make such structures unappealing as vehicles for taking on private equity, at least for big buyouts in the United States. With the removal of the tax disincentives across Europe, a few new publicly quoted buyout gamers have emerged. The largest are 2 French business, Wendel and Eurazeo. Both have actually accomplished strong returns on their buyout financial investments.

Private Equity Firm Definition – Nasdaq

( In the United States, where private business can choose, like private partnerships, not to be subject to corporate tax, Platinum Equity has ended up being one of the fastest-growing private companies in the country by competing to buy out subsidiaries of public companies.) With the removal of the tax disincentives throughout Europe, a couple of brand-new publicly priced estimate buyout players have emerged.

Private equity funds are illiquid and are risky since of their high use of financial obligation; furthermore, once investors have actually turned their money over to the fund, they have no say in how it’s managed. In compensation for these terms, investors need to anticipate a high rate of return – fund manager partner. However, though some private equity companies have actually attained exceptional returns for their investors, over the long term the average net return fund investors have actually made on U.S.

Private equity fund managers, meanwhile, have actually earned exceptionally appealing benefits, with little up-front investment. As payment for taking the initiative in raising money, handling investments, and marketing their benefits, they have structured agreements so that a big part of the gross returnsaround 30%, after adding management and other feesflows to them.

Public business pursuing a buy-to-sell strategy, which are traded daily on the stock market and answerable to shareholders, might supply a better deal for investors (tysdal lone tree). From where might a significant variety of openly traded rivals to private equity emerge? Even if they value the destinations of the private equity method in principle, few of today’s big public industrial or service companies are likely to adopt it.

Private Equity Software & Solutions, Built For Pe Investors …

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Likewise, couple of business managers would slip easily into a more investment-management-oriented function. Private equity partners usually are previous investment bankers and like to trade. Most leading business managers are former organisation system heads and like to handle (million investors state). Public monetary companies, nevertheless, may discover it easier to follow a buy-to-sell technique.

More private equity firms might decide, as U.S.-based Ripplewood made with the going public of RHJ International on the Brussels stock market, to drift an entire investment portfolio on the public markets. More skilled financial investment banks might follow the lead of Macquarie Bank, which produced Macquarie Capital Alliance Group, a company traded on the Australian Securities Exchange that concentrates on buy-to-sell opportunities.

( These examples are to be differentiated from the private equity firm Blackstone’s initial public offering of the firm that handles the Blackstone funds, but not the funds themselves.) A technique of versatile ownership could have broader appeal to large industrial and service companies than buying to sell – securities fraud racketeering. Under such a technique, a company hangs on to services for as long as it can add significant worth by enhancing their performance and fueling growth.

A decision to offer or spin off a company is viewed as the conclusion of an effective transformation, not the outcome of some previous tactical error. At the same time, the business is complimentary to hold on to an acquired service, providing it a potential benefit over private equity companies, which in some cases must give up rewards they ‘d understand by hanging on to financial investments over a longer duration.

What Is Private Equity? – Pitchbook

Flexible ownership can be expected to appeal the most to business with a portfolio of businesses that don’t share numerous customers or processes. Take General Electric. The company has shown over the years that business management can indeed include value to a diversified set of services. tysdal business partner. GE’s corporate center helps build general management abilities (such as cost discipline and quality focus) across its services and makes sure that broad patterns (such as offshoring to India and the addition of service offerings in producing services) are efficiently made use of by them all.

Undoubtedly, with its fabled management skills, GE is most likely much better equipped to correct functional underperformance than private equity firms are – securities exchange commission. To understand the advantages of flexible ownership for its investors, though, GE would need to be vigilant about the threat of keeping services after business management might no longer contribute any significant value.

How To Set Up A Private Equity Fund?

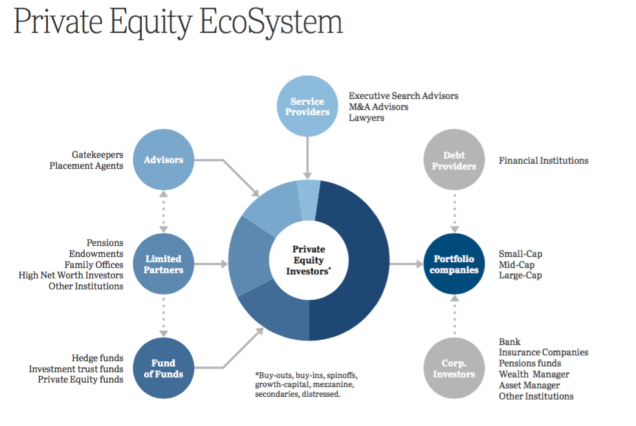

The most common source of private equity financial investment are private equity companies (also understood as private equity funds). You can think about private equity companies as a kind of investment club. The principal investors (likewise called Limited Partners) are organizations like mutual fund, pension funds, endowment funds, insurer, banks, and high net-worth individuals. And then last concern, who are the private equity people around both Trump and the Democrats?Goldman Sachs has a private equity arm, and Trump has had Goldman Sachs people around him. Peter Thiel has a fund, and Apollo has been around and is very near to Jared Kushner (prosecutors mislead money). I make certain that all the significant private equity firms have people who are close to Trump.

I imply, if you think of Blackstone, Stephen Schwartzman is the Trump individual, but Tony James has been ingratiating himself with the Democrats for as long as he can. And locations like the Center for American Progress invite him to speak. I’m not going to call names due to the fact that it’s humiliating, but he spoke on Capitol Hill at a seminar that was sponsored by numerous progressive groups around town.

These groups stated, well, we do not need to agree with what he says, we sponsor great deals of individuals that we don’t concur with. That’s real. However what this guy is searching for, he doesn’t care if you concur with him or not, he wants the imprimatur for having the ability to state, “Well, all of these different progressive groups in Washington have actually sponsored my speaking at this engagement or that engagement – fund manager partner.

I believe if you have an interest in the kinds of things that Warren had in the Stop Wall Street Looting Act, it will restrict the bad behavior. So generally I’m not interested in diminishing it; I’m interested in eliminating the bad behavior. The smaller sized private equity firms that purchase smaller sized companies actually do good.

Specific funds can have their own timelines, investment goals, and management viewpoints that separate them from other funds held within the exact same, overarching management firm. Successful private equity firms will raise numerous funds over their life time, and as companies grow in size and complexity, their funds can grow in frequency, scale and even uniqueness. To get more info regarding securities exchange commission and also - visit his blogs and -.

Prior to establishing Freedom Factory, Tyler Tysdal handled a growth equity fund in association with numerous celebs in sports and home entertainment. Portfolio company Leesa.com grew rapidly to over $100 million in incomes and has a visionary social mission to “end bedlessness” by contributing one bed mattress for every 10 offered, with over 35,000 donations now made. Some other portfolio companies were in the industries of wine importing, specialized financing and software-as-services digital signs. In parallel to handling possessions for companies, Ty was managing private equity in real estate. He has had a variety of successful personal equity investments and a number of exits in trainee real estate, multi-unit real estate, and hotels in Manhattan and Seattle.

Among the things we did is let the banking system consolidate and all of the regional banks that used to be able to make loans to little and medium sized business do not exist anymore. There’s nobody ready to do due diligence on some smaller sized, medium size enterprises. So many companies, as they get to a particular size, end up being desperate for more financing, and they rely on private equity and private equity is flooded with demands.

If we had a banking system that in fact worked, that might actually supply funding to little and medium sized enterprises. I believe these companies would more than happy not to go to private equity, since equity capital money or private equity money is the most pricey cash you can get, since you need to quit a big part of your ownership of your own company to get the cash.

Thanks for the interview! So then it seems like we need to not only end the bad habits at private equity funds, but likewise reconstruct a functional banking system. Yes, that’s right. Thanks for reading. Send me suggestions, stories I’ve missed, or comment by clicking on the title of this newsletter – securities fraud theft.

The Private Equity Business Buyer – Exit Your Way

When a business has actually been acquired by a private equity company, it remains in for some noteworthy modifications. It is the motive of a private equity business to find a business that is struggling economically or just having a bumpy ride growing, buy it and do whatever is necessary to turn the company around and offer it later for an earnings.

Private equity companies do not always obtain entire businesses. Often they buy assets in a piecemeal fashion. When they do buy companies outright it’s called a buyout. Using a combination of their own resources and debt, the latter of which is usually stacked onto the target business’s balance sheet, private equity business obtain having a hard time business and add them to their portfolio of holdings.

It’s not uncommon for the buyout procedure to lead to job cuts at target companies, which is one of the signature moves of private equity business. Layoffs are part of the cost-cutting steps that buyout business utilize to make an investment more lucrative for them when it comes time to exit the holding.

It’s not the objective of a private equity business to own a service permanently. After five to 7 years, it must money in and reveal investors profits. There are three main ways that a buyout business can do this:– It might choose to conduct an initial public offering, in which the holding company ends up being a publicly traded stock.

— The buyout company may even shed business to yet another private equity business in what’s called a secondary buyout, according to a 2012 “Wall Street Journal” article. Following a private equity buyout offer, target companies are most likely to have actually taken on more financial obligation than they had prior to the acquisition.

As soon as a buyout business exits private equity ownership, it needs to handle its debt or it will remain in risk of defaulting on its commitments. private equity firm.

Private equity includes equity and financial obligation financial investments in companies, facilities, real estate and other possessions. Private equity firms look for to invest in quality properties at attractive evaluations and use strategic, functional, and monetary knowledge to include worth. After an appropriate holding duration, a private equity firm seeks to monetize its investment at a premium to its acquisition expense, creating positive returns for its investors (conspiracy commit securities).

Private Equity Software & Solutions, Built For Pe Investors

These investors are called minimal partners (LPs). The supervisor of a private equity fund, called the general partner (GP), invests the capital raised from LPs in private companies or other properties and handles those financial investments on behalf of the LPs. * Unless otherwise noted, the details provided herein represents Pomona’s general views and viewpoints of private equity as a method and the current state of the private equity market, and is not meant to be a total or extensive description thereof.

Hedge funds have actually led the charge in the alternative investment community as a practical and growing segment of the buy side/asset gathering industry. Some of the brightest and most intelligent individuals from the industry have not only began hedge funds, however lately have actually begun big “institutional”, multi-strategy funds that cover the world looking for chances in which to trade.

How Does Private Equity Work?

The very term continues to stimulate admiration, envy, and in the hearts of many public business CEOs fear. Recently, private equity firms have filched huge and controversial sums, while stalking ever bigger acquisition targets. Certainly, the worldwide value of private equity buyouts larger than $1 billion grew from $28 billion in 2000 to $502 billion in 2006, according to Dealogic, a firm that tracks acquisitions.

Private equity companies’ track record for considerably increasing the worth of their investments has assisted fuel this growth. Their ability to attain high returns is typically credited to a variety of aspects: high-powered incentives both for private equity portfolio supervisors and for the operating supervisors of businesses in the portfolio; the aggressive usage of financial obligation, which supplies funding and tax advantages; a determined concentrate on money flow and margin enhancement; and liberty from restrictive public business guidelines. state prosecutors mislead.

That method, which embodies a combination of service and investment-portfolio management, is at the core of private equity’s success. Public companieswhich usually obtain services with the intent of hanging on to them and incorporating them into their operationscan beneficially discover or obtain from this buy-to-sell method. To do so, they first require to understand just how private equity firms employ it so effectively.

It doesn’t make sense when an obtained service will benefit from crucial synergies with the purchaser’s existing portfolio of services. It definitely isn’t the method for a company to profit from an acquisition whose primary appeal is its prospects for long-term organic growth. Nevertheless, as private equity firms have actually shown, the method is preferably suited when, in order to recognize an onetime, brief- to medium-term value-creation opportunity, purchasers must take straight-out ownership and control.

It can likewise be found with services that are undervalued due to the fact that their potential isn’t readily apparent. In those cases, as soon as the modifications needed to achieve the uplift in value have actually been madeusually over a period of two to six yearsit makes good sense for the owner to offer business and carry on to new opportunities.

Specific funds can have their own timelines, financial investment goals, and management viewpoints that separate them from other funds held within the same, overarching management firm. Successful private equity companies will raise lots of funds over their life time, and as firms grow in size and complexity, their funds can grow in frequency, scale and even specificity. For more information about private equity and also - check out the websites and -.

Tyler Tysdal is a long-lasting entrepreneur assisting fellow entrepreneurs offer their service for optimum value as Managing Director of Freedom Factory, the World’s Best Business Broker situated in Denver, CO. Freedom Factory assists business owners with the most significant offer of their lives.

Private equity firms raise funds from institutions and wealthy people and then invest that cash in buying and selling services. After raising a defined amount, a fund will near brand-new investors; each fund is liquidated, selling all its services, within a pre-programmed time frame, generally no greater than 10 years. indicted counts securities.

Private equity companies accept some restraints on their usage of investors’ cash. A fund management contract may restrict, for instance, the size of any single business financial investment. As soon as money is committed, nevertheless, investorsin contrast to investors in a public companyhave practically no control over management (tens millions dollars). Although many firms have an investor advisory council, it has far fewer powers than a public company’s board of directors.

Private Equity Firms Raised More Money In 2019 Than They Ever …

Rather, private equity companies work out control over portfolio business through their representation on the business’ boards of directors. Normally, private equity firms ask the CEO and other leading operating managers of a business in their portfolios to personally purchase it as a way to guarantee their commitment and inspiration.

In accordance with this design, operating supervisors in portfolio organisations typically have greater autonomy than unit supervisors in a public company. Although private equity companies are starting to establish operating abilities of their own and therefore are now more most likely to take an active function in the management of an acquired business, the conventional design in which private equity owners provide guidance however don’t step in straight in day-to-day operations still prevails.

Fund profits are primarily realized via capital gains on the sale of portfolio services. Because funding acquisitions with high levels of financial obligation enhances returns and covers private equity firms’ high management charges, buyout funds look for out acquisitions for which high debt makes good sense. civil penalty $. To ensure they can pay funding expenses, they look for steady capital, restricted capital financial investment requirements, a minimum of modest future development, and, above all, the opportunity to improve efficiency in the short to medium term.

In some countriesparticularly the United Statesthat offers them essential tax and regulative advantages over public business. The benefits of buying to sell in such scenarios are plainthough, again, frequently overlooked. Think about an acquisition that rapidly increases in valuegenerating a yearly financier return of, state, 25% a year for the very first 3 yearsbut consequently earns a more modest if still healthy return of, say, 12% a year.

A varied public business that achieves identical functional efficiency with the gotten businessbut, as is common, has bought it as a long-lasting investmentwill make a return that gets closer to 12% the longer it owns the company. For the public company, hanging on to business once the value-creating modifications have actually been made dilutes the final return.

Under their previous owners, those services had frequently suffered from neglect, inappropriate performance targets, or other constraints. Even if well handled, such companies may have lacked an independent track record since the moms and dad company had actually integrated their operations with those of other units, making the companies hard to worth. Sales by public companies of undesirable organisation units were the most crucial category of large private equity buyouts till 2004, according to Dealogic, and the leading firms’ extensively appreciated history of high investment returns comes largely from acquisitions of this type.

( See the display “Private Equity’s New Focus.”) This has actually produced brand-new challenges for private equity companies. In public business, quickly recognized enhancements in performance frequently have currently been achieved through better business governance or the advocacy of hedge funds. For example, a hedge fund with a significant stake in a public company can, without needing to buy the company outright, pressure the board into making valuable modifications such as offering unnecessary properties or spinning off a noncore system.

Private Equity: Overview, Guide, Jobs, And Recruiting

When KKR and GS Capital Partners, the private equity arm of Goldman Sachs, acquired the Wincor Nixdorf unit from Siemens in 1999, they had the ability to deal with the incumbent management and follow its plan to grow revenues and margins. In contrast, since taking Toys “R” United States private in 2005, KKR, Bain Capital, and Vornado Real Estate Trust have actually needed to change the whole leading management group and develop an entire brand-new strategy for the service.

And it might become harder for firms to squander of their investments by taking them public; given the present high volume of buyouts, the number of big IPOs might strain the stock markets’ ability to take in brand-new concerns in a couple of years. Even if the present private equity financial investment wave declines, however, the unique advantages of the buy-to-sell approachand the lessons it uses public companieswill remain – private equity fund.

On the other hand, a company system that has belonged to a public business’s portfolio for a long time and has actually performed adequately, if not marvelously, normally does not get concern attention from senior management. In addition, because every financial investment made by a private equity fund in a service should be liquidated within the life of the fund, it is possible to precisely measure cash returns on those financial investments (pay civil penalty).